News / QQQTrades.Club

$4.2 Trillion in Options Expire Today

$4.2 Trillion in Options Expire Today

June 16, 2023

Its like all of the nails in your house will melt away at 3pm central time today.

According to Rocky Fishman founder of Asym 500, $4.2 trillion of options contracts, that include monthly and quarterly options expire today. To give you a visual, this is like the nails that hold your first and second floor of your house together will disincarnate at 3pm central time today.

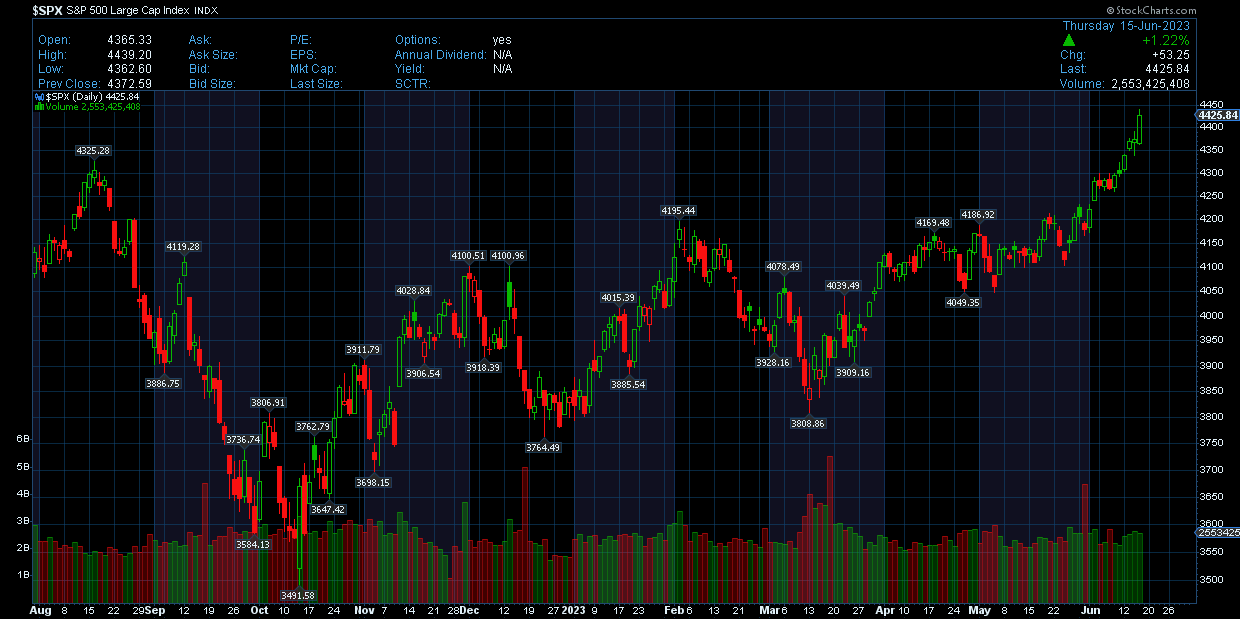

As of the close on Thursday, SP500 was up 1.22% finishing a 6% increase since the the start of June. WOW! What could go wrong.

The take away from all of this is that months ago markets where bearish and then Nvidia had a good quarter vs quarter earnings report and the AI narrative drove index’s higher. Today could be the start of the end of all that.

My Fed Meeting / OpEx 50% off Special will expire on Monday evening. Monthly subscription is $25. The OpEx Special brings that price down to $12.50 a month for the life of your subscription. Take advantage of this offer and support QQQTrades.Club!

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

$4.2 Trillion in Options Expire Today

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

$4.2 Trillion in Options Expire Today

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024