News / QQQTrades.Club

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

August 2, 2023

Getting downgraded is not a good thing. Futures are lower this morning.

Fitch Ratings downgraded the United States’ long-term foreign currency issuer default rating to AA+ from AAA on Tuesday.

The downgrade was due to “expected fiscal deterioration over the next three years,” an erosion of governance and a growing general debt burden.

Fitch also highlighted the rising general government deficit, which it anticipates will rise to 6.3% of gross domestic product in 2023, from 3.7% in 2022.

The White House disagreed with Fitch’s downgrade, saying that it “defies reality.”

This isn’t the first time a rating agency has downgraded the U.S. Standard & Poor’s cut the nation’s credit rating to AA+ from AAA in 2011 after Washington managed to avoid a default.

End of the Run?

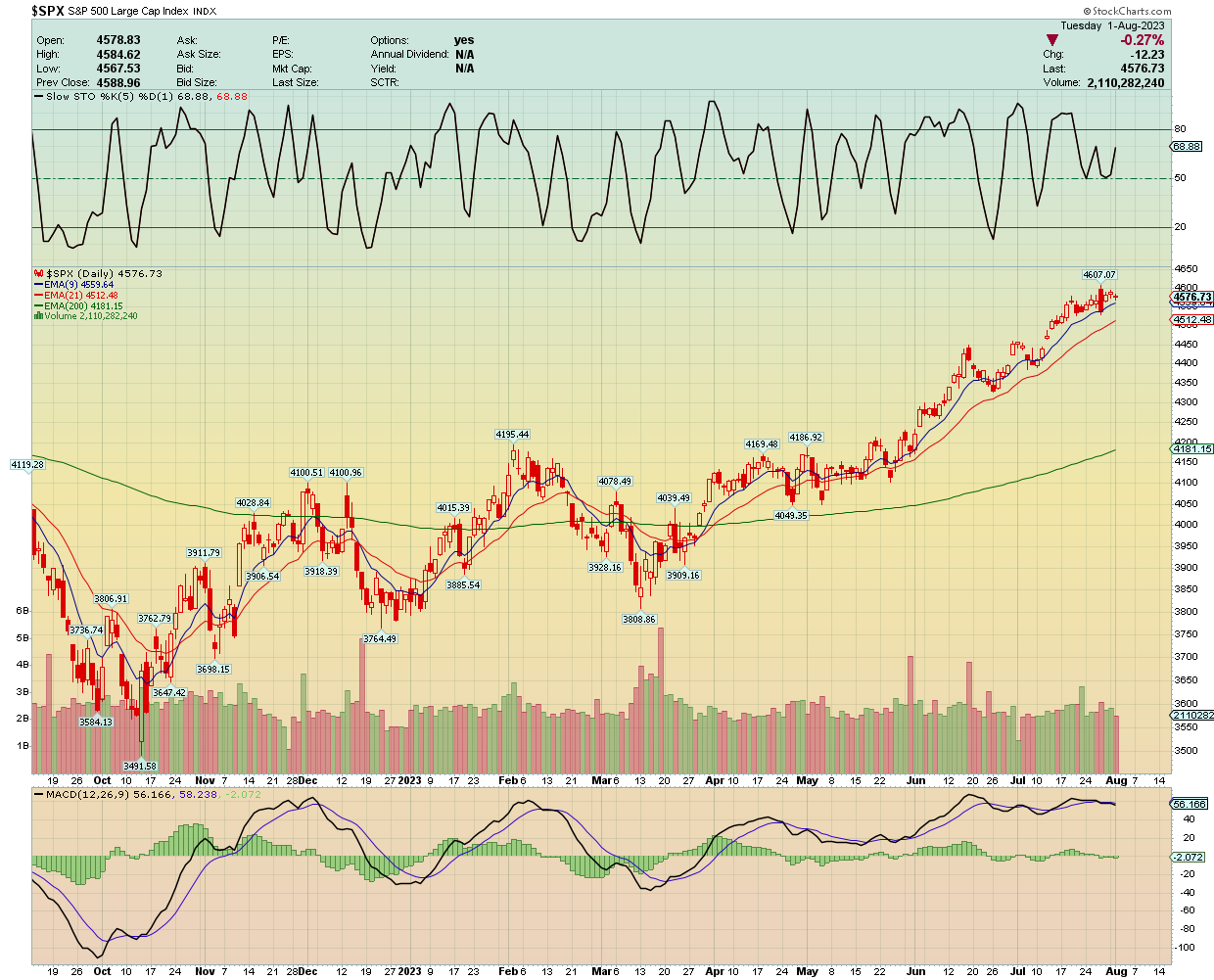

SP500 has been on a heck of run this year. This morning futures are down, which can always change by mid day. Below are charts of the SP500 on a daily and monthly perspective. Each of them look semi healthy yet on the daily we are beginning to see some rolling over ever so slightly towards the 9 day ema. On the monthly we most likely could see a pull back to the 9 month EMA, 4300 area forming the old school cut and handle.

Taking a look at charts from a longer term perspective can bring us more clarity of the intermediate term direction a index or stock is going.

Daily Chart

Monthly Chart

Let take a look at Tesla.

Subscribe for 55% off the monthly fee of $25.

As you may know, I work with Kerry Grinkmeyer of Best of US Investors. We have launched our new website, www.BUS13.ai, go check it out!

Share this article:

More in QQQTrades.Club:

Hedge funds and banks typically use multiple time frames for intraday trading

Hedge funds and banks typically use multiple time frames for intraday trading, as this allows them to gain a comprehensive...

Trent Grinkmeyer

August 30, 2024

Nvidia Earnings Call: A Record Quarter with a Twist

Nvidia’s Q2 earnings call was a mixed bag, with the company reporting a record quarter but also revealing a drop...

Kerry Grinkmeyer

August 29, 2024

Nvidia Earnings: A Critical Moment for Big Tech

As we approach Nvidia’s earnings report, the tech world holds its breath. This isn’t just about one company’s performance; it’s...

Trent Grinkmeyer

August 28, 2024

The Sleeping Giant: Why Intel is an Undervalued Stock

As the world’s largest semiconductor company, Intel (INTC) has long been a household name in the tech industry. However, despite...

Kerry Grinkmeyer

August 23, 2024

The Trillion Dollar Addiction...

The Trillion Dollar Addiction That Amazon, Google, Meta and Microsoft Will Be Selling Next Year As I discussed in my...

Kerry Grinkmeyer

August 19, 2024

What is an AI Agent? What Can It Do For You? Where Can You Get One?

As I discussed with my tribe during our recent stock talk, I’m excited to share with you the concept of...

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

August 18, 2024