News / QQQTrades.Club

Anticipatioooon...Anticipaaaaation...Jerome is Making Me Wait

Anticipatioooon…Anticipaaaaation…Jerome is Making Me Wait

June 14, 2023

For though who grew up in the 70's

Heinz Ketchup Commercial Click Here

Fed Futures are pointing towards less than a 10% chance of a rate cut as of this morning. It was 100% yesterday they would not hike. There’s scene in Dumb and Dumber that reminds me of today. ‘So your saying there’s a chance’

According to the COT Report released Friday, the amount of Large Speculators shorting the equity markets has declined vs the report release on the 2nd of June.

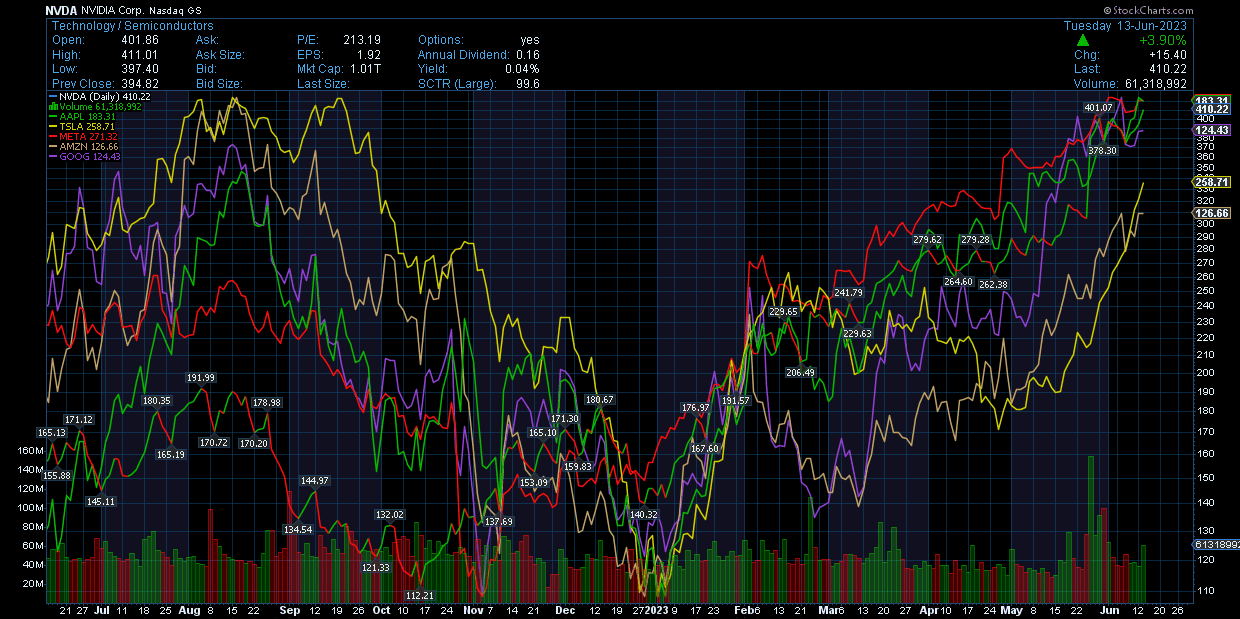

At this point, many of the stocks that have pushed this market higher YTD are beginning to trade sideways.

Conclusion

Its looking more like a ‘skip’ on rates hike is very possible. If not….WOW! A lot of downside could be had.

Special Offer!

I am running a 50% off the $25 monthly and $300 annual subscription special this week in honor of todays Fed meeting and OPEX on Friday.

Paid Subscribers

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

Anticipatioooon…Anticipaaaaation…Jerome is Making Me Wait

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

Anticipatioooon…Anticipaaaaation…Jerome is Making Me Wait

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024