News / QQQTrades.Club

CHINA, To Much Dependence

CHINA, To Much Dependence

July 6, 2023

Yet opportunity

China makes just about everything we use on a daily basis. Designed to be that way, China enticed manufactures back in the ‘70’s, ‘80’s and ‘90’s to move manufacturing to China with cheap labor, increase in margins and profits. It worked. Now China holds the keys to the manufacturing castle.

Yesterday the news came out that China will restricted the amount of germanium and gallium exports starting August 1st. What is gallium and germanium?

“Gallium is mainly used in the electronics industry to produce heat-resistant semiconductor wafers that can operate at higher frequencies. Germanium, on the other hand, is used in fibre optic cables and is essential in the defence and renewable energy sectors.", according to The Economic Times. (take in account that this a translated to English if you decided to read this article)

China produces 60% of the germanium in the world according to Critical Raw Materials Alliance. The rest comes from Canada, Finland, Russia and the US. 80% of gallium is produced by China.

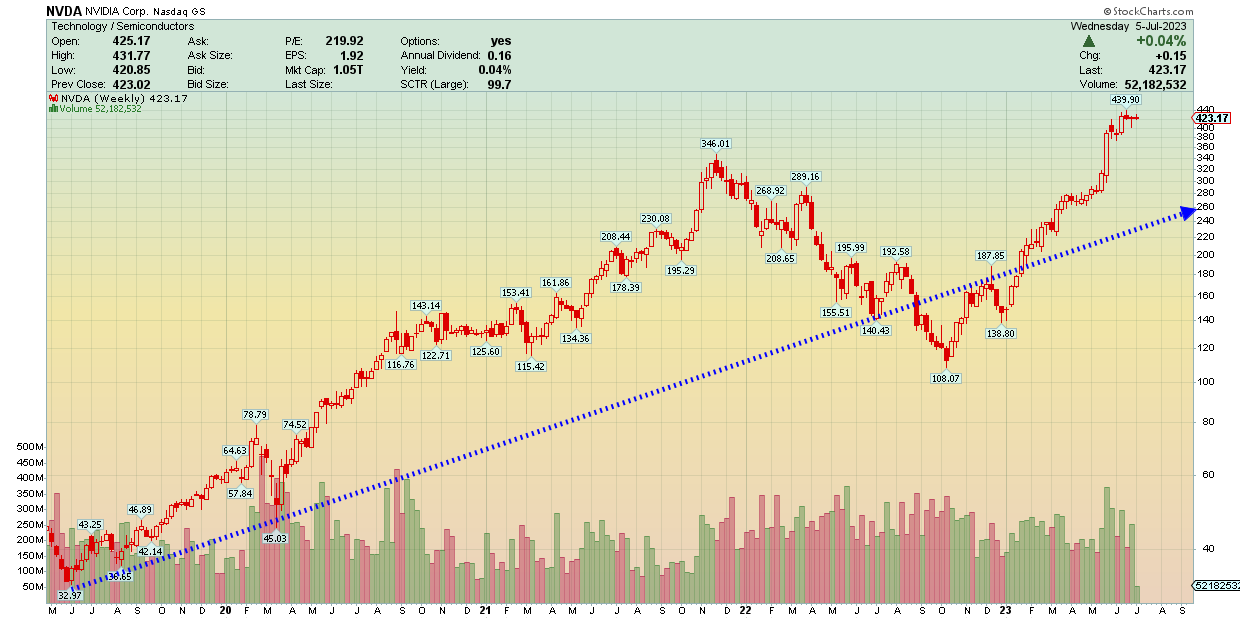

I find all of this ironic that these restrictions come out just as the semiconductor, AI headline rush has been driving company’s such as #Nvidia and others higher for the last 6 months. China may not shoot missiles at the US, Finland, Germany, Netherlands, France, the leaders in imports of both germanium and gallium, but they can play economic warfare.

So what does this mean for the Nvidia’s, AMD’s, semiconductor and fiber optic company’s of the world? Probably a temporary drop in the stock prices driven by the headline news of this event. But also a possible buying opportunity.

NVIDA…only down $0.92 in premarket

Markets and the true world economics' work in silos. They are have come disconnected from one another. So if your a long-term investor, consider that the headlines drive much of the markets movements. Presently NVIDA trades at a P/E ratio of 220. The last time I saw such great P/E numbers was during the DOT.COM era.

My suggestion…keep some of those profits this time.

Subscribe Today!

In celebrations of 4th of July, monthly and annual subscriptions are 55% OFF! This offer will stay in place until QQQTrades.Club hits 1000 paid subscribers. This special reduces the monthly subscription price from $25 a month to $13.75 a month or $140 annually from $300!

Included in the Paid Subscription

QQQTrades Stock Ideas: list of stocks that I see as potential trades (three weeks or less)

Intermediate Term Portfolio Allocation Ideas: a core portfolio that is based on MACRO economics conditions.

Market and MACRO economic commentary.

As well as additional knowledge and information.

Subscribe Today!

Yield Curve and SKEW Review

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

CHINA, To Much Dependence

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

CHINA, To Much Dependence

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024