News / QQQTrades.Club

Field Curve is Flattening | Recession Ahead?

Field Curve is Flattening | Recession Ahead?

October 24, 2023

This was meant to go out on Monday

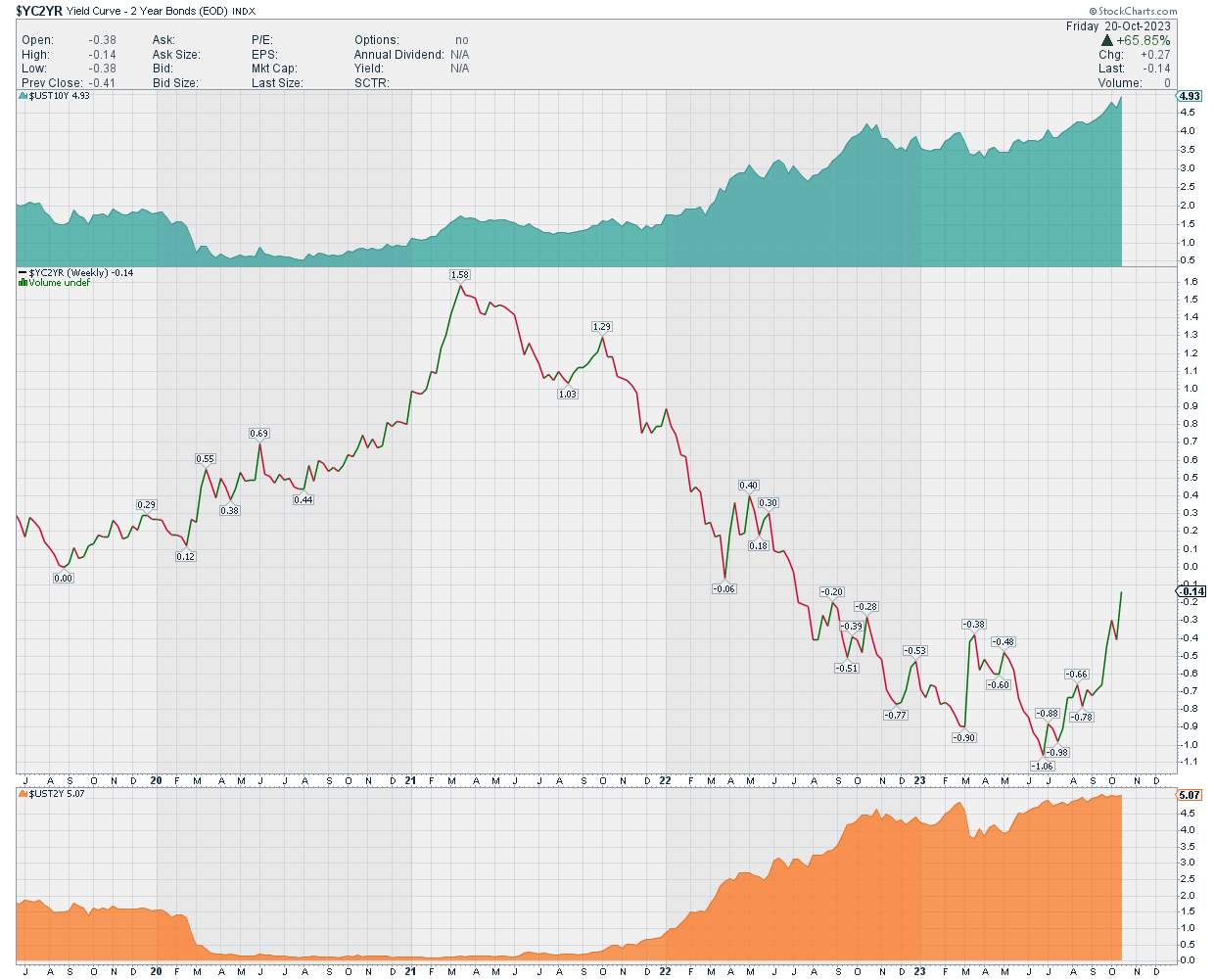

The yield curve has been much ignored here recently after its sizable negative run earlier this year. Today the yield curve sits at a -.12% In comparison to its low at -1.06%. Historically, when the yield curve makes a sizable move to the negative side it’s a leading indicator to a weakening economic condition. As the curve starts to flatten out, it has historically indicated the beginnings of a recession. Once again we are just shy of a 0% yield curve, which would indicate, based on history we are entering a recession. The question is, are we?

I believe so. I do see how the cost of goods, the rise of inflation over many of our basic needs is starting to take a toll and slowing our economy. Just today I saw on the news that Halloween candy is up 13% year over year because of the cost of the ingredients. If candy isn’t a leading indicator to rising inflation, I don’t know what it is. Just kidding. Yet I would say every time I go to the grocery store the cost of my groceries continues to go up.

Just last week we saw the VIX, volatility index of the S&P 500 break over 20. Today we will most likely see a break over 22, which is another indicator of a bear market in the S&P 500.

This week is a big week for earnings with Amazon reporting as well as many other Magnificent 7stocks. My eye is on Amazon, because it represents the consumer . Even though Amazon has web services, which will also indicate potential slowing on a corporate level, the consumer is what is the backbone of the United States economy. We are consumption base nation, and when we don’t consume our economy slows.

The state of QQQTrades.Club

As many of you probably noticed I did not write anything last week. Ayear and a half ago I starting working with the Best of US Investors. Friday, two weeks ago my role in the company escalated and has become the majority of my time spent. Due to this, I’ve decided to integrate my writings into the Best of US Investors Discord under the Everyone tab. When it comes to my paid subscriber program, I will be ending that. I’ll no longer be providing ideas on different allocations. I’ve decided to move all of that towards the Best of US Investors subscription programs, which you are welcome to subscribe to.

I do appreciate all the support since starting this and I hope to see you over at the Best of US Investors website and Discord in the future. In the meantime, I will be periodically posting on the Discord under our Everyone tab, which is available for free, you’ll just have to subscribe to our Discord, which you can do by clicking the link below.

Join the Best of US Investors Discord

Learn more about Best of US Investors by going to our website. Click Here.

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

Field Curve is Flattening | Recession Ahead?

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

Field Curve is Flattening | Recession Ahead?

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024