News / QQQTrades.Club

‘I’ll Just Ride it Out’

‘I’ll Just Ride it Out’

October 26, 2023

Buy and holders justify losing money

Yesterday I was in Birmingham visiting family and decided to go for a mountain bike ride at the local state park. The state park has some incredible mountain bike trails. I’ve been riding it for years. On this day, I cross paths with a person, and we both stopped at the same point to catch our breath. Remember, I’m living in the flattest of areas, and I go up to more of a hilly environment, it takes the breath out of you. So we get to talking which then leads into talking about what we do for a living. I share with them that I write a newsletter as well as building an investment research and ideas company called Best of US Investors. Of course this leads to the question ‘what do I think about the stock market’.

It is amazing to me how the mind works. I recently lost my best friend, second to my wife. Indie was 13 years old in dog years, so I guess that makes her 91 years old? I didn’t realize how attached i’d become to her. It’s been two weeks since her passing, I still get teary-eyed every morning when making coffee and stretching on the kitchen floor where she and I would each do our version of downward dog. In that two weeks I have found myself justifying why I should get over it and move on. There is really nothing I can do at this point other than just being lonely for her company. Yet, I find it interesting when evaluating myself in my reaction to it how I come up with these different scenarios to comfort myself. This brings me to my conversation with the person I ran into mountain biking yesterday. They went on to share with me that they own Tesla and some other stocks, and they have money in a 401(k) and that they’re starting to notice the decline in the value of their investments over the last couple months. Yet they quickly shared their justification why they’ll just hold onto it and “ride it out”.

The financial advisor industry is notorious for this by and hold, history says it markets have recovered over the last 100 years. I was once told to understand a persons, motives, understand how they get paid. Investment firms get paid mostly from assets under management. They do not get paid, the majority of the time holding cash for long periods of time. So the excuses to just “ride it out” actually benefit investment firm more than the client. Yet the question is when do I sell and then when do I get back in? Reason nobody can truly answer this is because they don’t take the time to study history or just come up with a simple strategy.

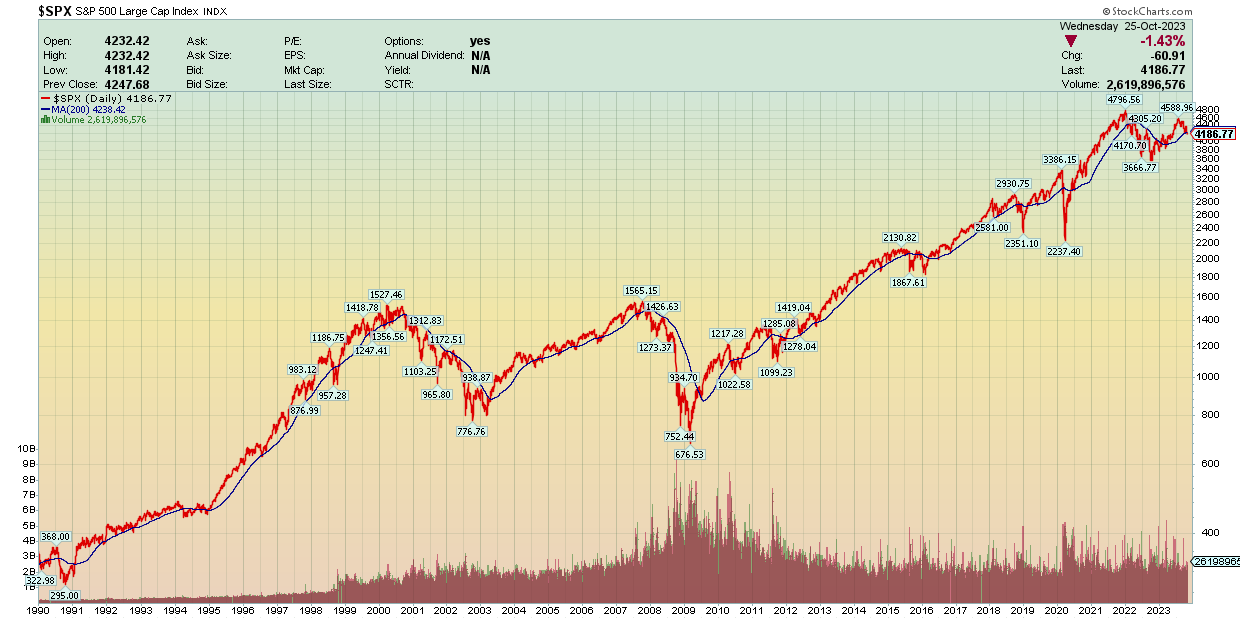

I’m gonna give you a simple strategy that you can build a long-term investment process around. If it’s stocks, ETF, bond yields or anything for the most part, when the investment breaks through to the downside the 200 day simple moving average, chances are that investment is headed south. If that investment then breaks through the 200 day simple moving average towards the north side, chances are that investment is going higher. Below is this S&P 500 in recently and a chart going back to 1980.

S&P 500 Daily

S&P 500 1980 to Present

One other thing to take an account. What does it take to get back to break even when you lose money? If you loose -20%, you need to be up +25% to get your money back to breakeven. If you’re down -44%, you need to be up +78% to get back to breakeven. Unfortunately, we continue to age even when we loose money causing us take more risk to meet our goals after ‘riding it out’.

Just remember life does not have to be overly complicated and neither does investing for the long term. Markets are what they are. Accepting them is the hardest part.

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

‘I’ll Just Ride it Out’

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

‘I’ll Just Ride it Out’

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024