News / QQQTrades.Club

Oil and Japan Making Moves

Oil and Japan Making Moves

July 28, 2023

Oil could see higher moves

Oil on the Move Higher

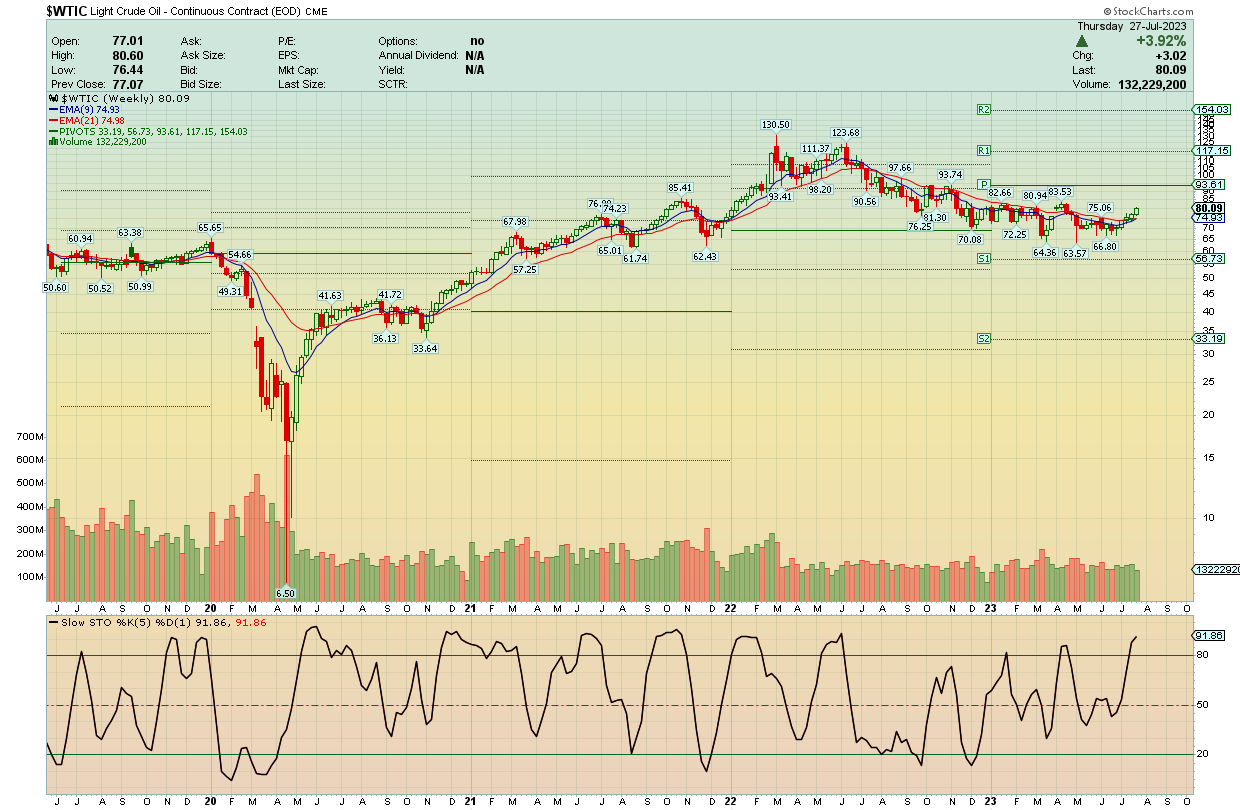

WTI Crude has made a move higher over last number of weeks. Breaking above the 9 and 21 day EMA on a weekly basis with a price target of $94. This is inflation. The more it cost a the pump, the less the consumer has in their pockets.

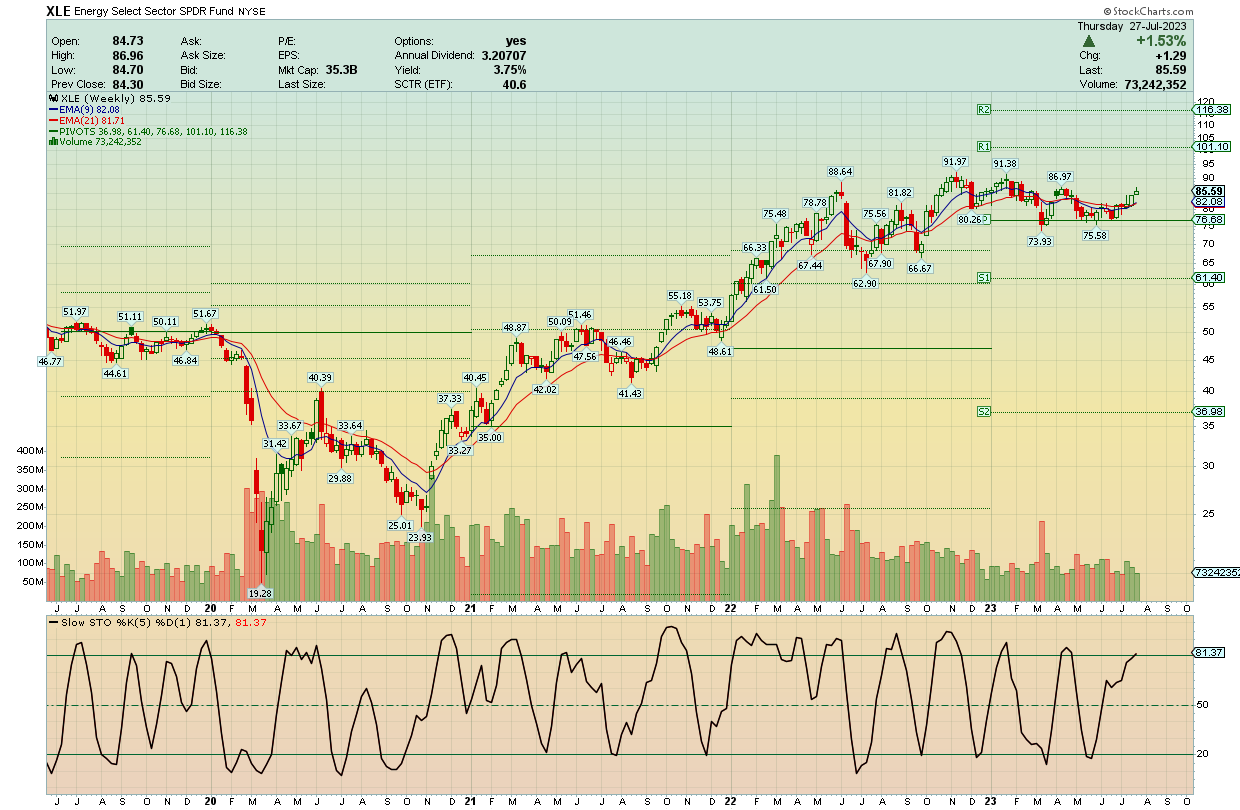

XLE on a weekly chart may see some pull back towards support. Could create a buying opportunity for a possible move higher. Presently above 9 day and 21 day EMA.

Bank of Japan Makes Big Move on Interest Rate Policy

The Bank of Japan has introduced flexibility into its yield curve control, effectively expanding its tolerance for 10-year Japanese government bond yields. This move is seen as a way to enhance the sustainability of the current easing framework, while also allowing the BoJ to respond to upside risks to inflation. Some analysts believe that this could be the start of a more significant tightening cycle, but others believe that the central bank is still not ready to raise interest rates. Only time will tell what the long-term implications of this move are, but it is clear that the BoJ is starting to move away from its ultra-loose monetary policy.

Subscribe Today!

Price Reduce to $13.5 for a Limited Time!

Receive:

QQQTrades Stock Ideas List

Intermediate Term Allocation Portfolio

Market Commentary

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

Oil and Japan Making Moves

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

Oil and Japan Making Moves

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024