News / QQQTrades.Club

The Accelerating Pace of Technology Adoption: From Decades to Years

The Accelerating Pace of Technology Adoption: From Decades to Years

July 28, 2024

How fast will AI adoption happen?

I’m In today’s fast-paced digital world, it’s easy to forget that the lightning-quick adoption of new technologies is a relatively recent phenomenon. As we scroll through our smartphones and effortlessly navigate the internet, it’s worth reflecting on how the timeline for widespread technology adoption has dramatically shortened over the years.

The Long Road to Ubiquity

Not too long ago, the journey from innovation to mass adoption was a marathon, not a sprint. Take computers and the internet, for example. These transformative technologies took approximately 20-25 years to reach widespread adoption, defined as 80-90% of the population using them regularly. This lengthy timeline allowed for gradual integration into society, giving people time to adapt and businesses to evolve their practices.

The Social Media Revolution

Fast forward to more recent innovations, and we see a marked acceleration in adoption rates. Social media platforms, which have fundamentally changed how we communicate and share information, reached high adoption levels in about 14 years. This represents a significant compression of the adoption timeline compared to earlier technologies.

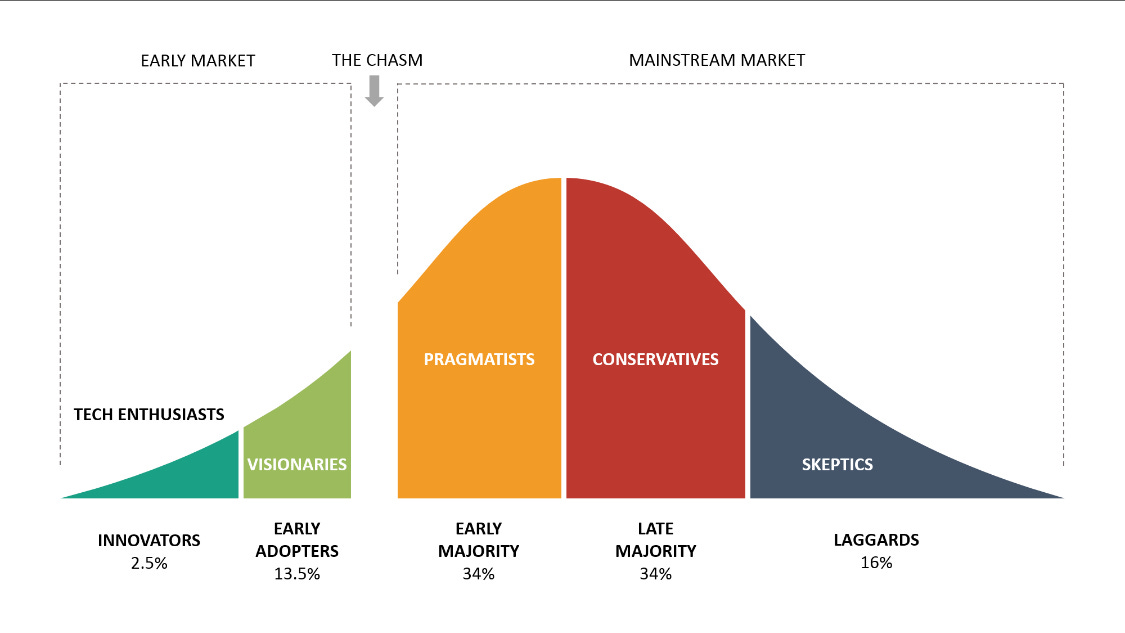

Understanding the Adoption Curve

To comprehend this shift, it’s helpful to consider the technology adoption lifecycle model. This model breaks down adopters into different groups:

1. Innovators (2.5% of the population)

2. Early Adopters (13.5%)

3. Early Majority (34%)

4. Late Majority (34%)

5. Laggards (16%)

This distribution helps explain why some technologies take longer to reach mass adoption – there’s a natural progression through these groups, each with different motivations and hesitations about embracing new tech.

Factors Influencing Adoption Speed

Several key factors contribute to how quickly a technology is adopted:

1. Ease of use: User-friendly technologies tend to spread faster.

2. Perceived benefits: Clear advantages over existing solutions accelerate adoption.

3. Network effects: Some technologies become more valuable as more people use them, creating a snowball effect.

4. Societal and cultural factors: The broader context can either facilitate or hinder adoption.

The Smartphone Phenomenon

Perhaps no technology better exemplifies the accelerating pace of adoption than smartphones. Despite initially high costs, smartphones saw rapid adoption due to their compelling features and growing ecosystem of apps. The convergence of multiple technologies into a single, portable device created an irresistible value proposition for many consumers.

Not All Technologies Are Created Equal

It’s important to note that not every new technology achieves widespread adoption. For instance, 3D televisions failed to meet expected adoption levels despite initial hype. This serves as a reminder that technological progress isn’t always linear or predictable.

The Trend Towards Faster Adoption

While there’s no one-size-fits-all timeline for technology adoption, the overall trend is clear: newer technologies tend to be adopted more quickly than their predecessors. This acceleration is driven by factors such as:

1. Increased digital literacy across populations

2. More robust technological infrastructure

3. Globalization and faster information spread

4. Higher consumer expectations for innovation

Looking Ahead

As we move forward, it’s likely that the pace of technology adoption will continue to accelerate. However, it’s crucial to remember that adoption rates can still vary widely based on the specific technology and market conditions. As consumers and businesses, staying informed and adaptable will be key to navigating the ever-evolving technological landscape.

In conclusion, while the journey from innovation to widespread adoption has shortened significantly, it remains a complex process influenced by numerous factors. Understanding these dynamics can help us better anticipate and prepare for the technological changes that will undoubtedly shape our future.

Share this article:

More in QQQTrades.Club:

A Deep Dive into America's Economic Powerhouse

September 15, 2024 By Trent Grinkmeyer In an era of economic uncertainty, the Federal Reserve stands as a beacon of...

Trent Grinkmeyer

September 16, 2024

Hedge funds and banks typically use multiple time frames for intraday trading

Hedge funds and banks typically use multiple time frames for intraday trading, as this allows them to gain a comprehensive...

Trent Grinkmeyer

August 30, 2024

Nvidia Earnings Call: A Record Quarter with a Twist

Nvidia’s Q2 earnings call was a mixed bag, with the company reporting a record quarter but also revealing a drop...

Kerry Grinkmeyer

August 29, 2024

Nvidia Earnings: A Critical Moment for Big Tech

As we approach Nvidia’s earnings report, the tech world holds its breath. This isn’t just about one company’s performance; it’s...

Trent Grinkmeyer

August 28, 2024

The Sleeping Giant: Why Intel is an Undervalued Stock

As the world’s largest semiconductor company, Intel (INTC) has long been a household name in the tech industry. However, despite...

Kerry Grinkmeyer

August 23, 2024

The Trillion Dollar Addiction...

The Trillion Dollar Addiction That Amazon, Google, Meta and Microsoft Will Be Selling Next Year As I discussed in my...

Kerry Grinkmeyer

August 19, 2024