News / QQQTrades.Club

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

August 2, 2023

Getting downgraded is not a good thing. Futures are lower this morning.

Fitch Ratings downgraded the United States’ long-term foreign currency issuer default rating to AA+ from AAA on Tuesday.

The downgrade was due to “expected fiscal deterioration over the next three years,” an erosion of governance and a growing general debt burden.

Fitch also highlighted the rising general government deficit, which it anticipates will rise to 6.3% of gross domestic product in 2023, from 3.7% in 2022.

The White House disagreed with Fitch’s downgrade, saying that it “defies reality.”

This isn’t the first time a rating agency has downgraded the U.S. Standard & Poor’s cut the nation’s credit rating to AA+ from AAA in 2011 after Washington managed to avoid a default.

End of the Run?

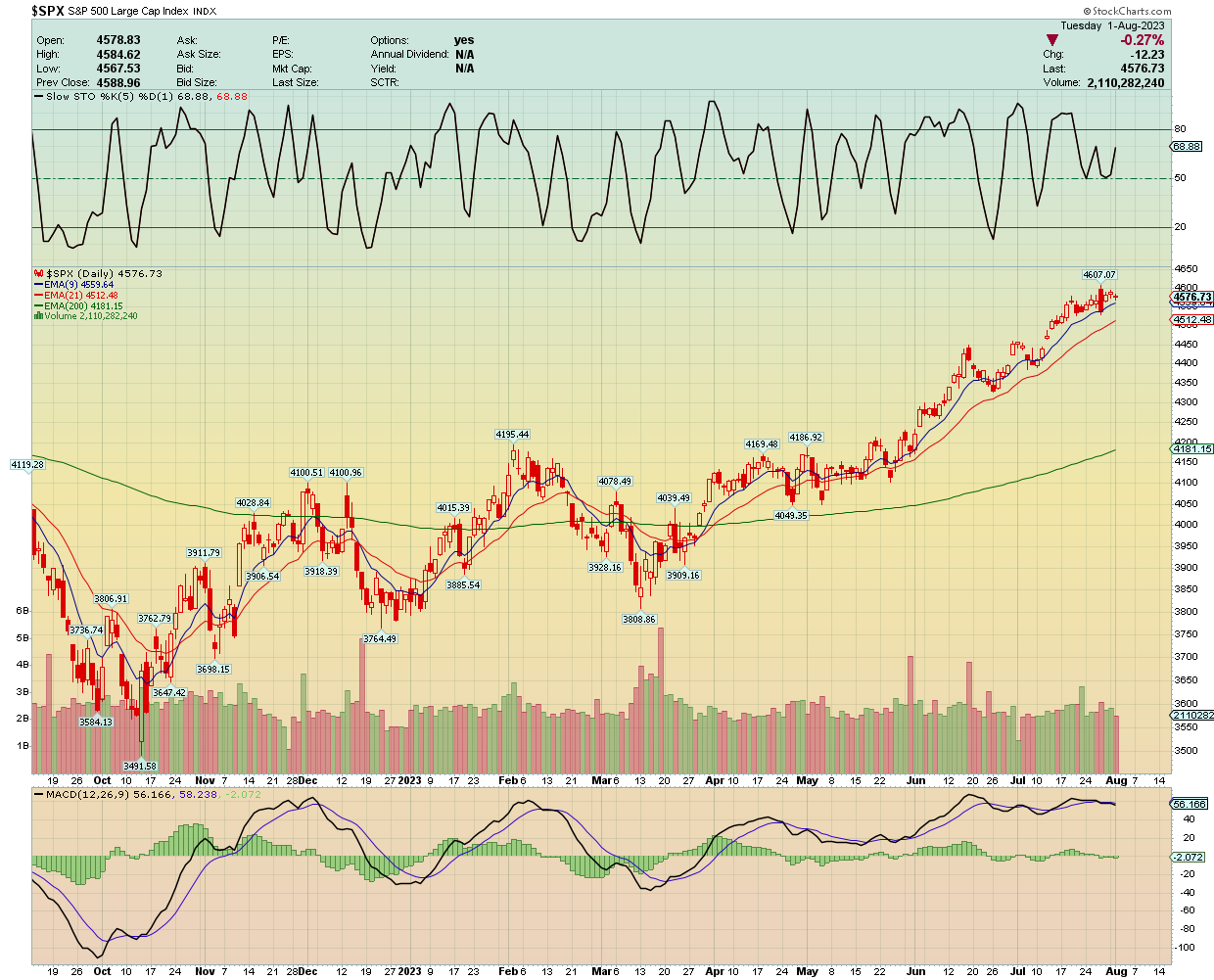

SP500 has been on a heck of run this year. This morning futures are down, which can always change by mid day. Below are charts of the SP500 on a daily and monthly perspective. Each of them look semi healthy yet on the daily we are beginning to see some rolling over ever so slightly towards the 9 day ema. On the monthly we most likely could see a pull back to the 9 month EMA, 4300 area forming the old school cut and handle.

Taking a look at charts from a longer term perspective can bring us more clarity of the intermediate term direction a index or stock is going.

Daily Chart

Monthly Chart

Let take a look at Tesla.

Subscribe for 55% off the monthly fee of $25.

As you may know, I work with Kerry Grinkmeyer of Best of US Investors. We have launched our new website, www.BUS13.ai, go check it out!

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

The US Downgraded by Fitch | SP500 and Tesla Turning South for Longer?

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024