News / QQQTrades.Club

Understanding the Impact of Federal Reserve Interest Rates on the Economy and Your Wallet

Understanding the Impact of Federal Reserve Interest Rates on the Economy and Your Wallet

September 20, 2023

Will he keep raising?

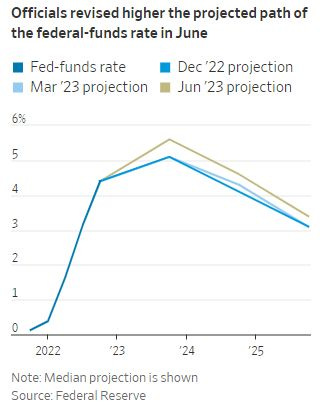

The Federal Reserve’s decisions on interest rates have far-reaching implications for the economy and individual financial planning. As of September 13, 2023, the effective federal funds rate stands at 5.33%, with a year-over-year percent change of +128.8%. But what does this mean for you and the economy at large? Let’s dive in.

The Federal Funds Rate and Its Impact

What Is the Federal Funds Rate?

The federal funds rate is the interest rate at which banks lend money to each other overnight. It serves as a benchmark for various other interest rates and is a key tool used by the Federal Reserve to control monetary policy.

How Does It Affect You?

1. Consumer Borrowing: A higher federal funds rate generally leads to higher interest rates for consumer loans, including mortgages, car loans, and credit cards.

2. Savings Accounts: If you’re a saver, higher rates can be good news as the interest rates on savings accounts and CDs may increase.

3. Investments: If you’re an investor, be cautious. Higher interest rates can lead to lower stock prices as borrowing costs for companies increase, affecting their profitability.

Mortgage Rates and Real Estate

Current Mortgage Rates

As of September 8, 2023, the conventional mortgage rate is 7.2%.

What Does This Mean for Homebuyers?

1. Home Buying: Higher mortgage rates can make home buying more expensive, potentially slowing down the real estate market.

2. Refinancing: If you’re an existing homeowner, higher rates may make it less advantageous to refinance your mortgage.

3. Rent: Higher mortgage rates could also drive up rent prices as demand for rentals may increase.

Treasury and Corporate Bond Rates

Other Interest Rates to Consider

– 10-year treasury note: 4.29% (September 15, 2023)

– 30-year treasury bond: 4.37% (September 15, 2023)

– Moody’s Aaa bonds: 5.03% (September 15, 2023)

– Moody’s Baa bonds: 6.08% (September 15, 2023)

Implications for the Economy and Investors

1. Government Borrowing: Higher treasury rates mean the government pays more to borrow money, which could impact public spending.

2. Investor Returns: Investors holding treasury bonds will see higher yields but may also experience a decrease in bond prices.

3. Business Financing: Higher interest rates can make it more expensive for businesses to finance expansion or operations.

4. Investor Risk: Higher rates on corporate bonds could make them more attractive compared to stocks, but they also indicate higher perceived risk.

Overall Economic Impact

1. Inflation: Higher interest rates can help control inflation by reducing consumer spending and borrowing.

2. Economic Growth: Conversely, higher rates can also slow down economic growth by making borrowing more expensive for both consumers and businesses.

Conclusion

Understanding the Federal Reserve’s interest rate decisions can help you make more informed decisions about your finances, such as when to buy a home, when to invest, and how to manage debt. Stay informed and plan wisely!

Subscribe for $13 a month.

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

Understanding the Impact of Federal Reserve Interest Rates on the Economy and Your Wallet

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

Understanding the Impact of Federal Reserve Interest Rates on the Economy and Your Wallet

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024