News / QQQTrades.Club

Not Even With A 10ft Poll

Not Even With A 10ft Poll

October 4, 2023

Voodoo in the air

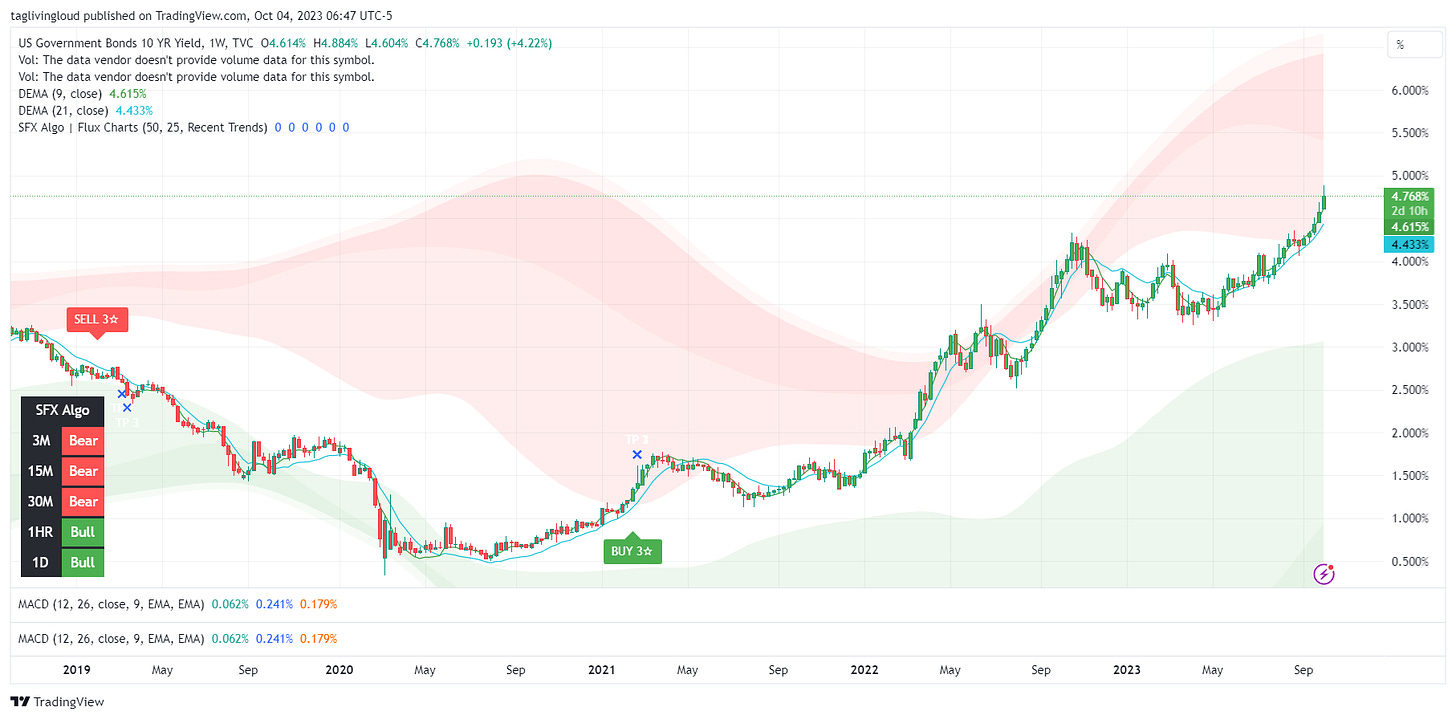

Nope! Nothing looks attractive at this point especially the Magnificent 7. On Monday 111 stocks were up of the 500 in the S&P 500. The remaining stocks where down on an average -1.72%. This should’ve been an indicator to many that Tuesdays jump in the VIX over 20 and the selloff in the S&P, DOW (now negative YTD) along with the NASDAQ. The US 10 year treasury yield is now at 4.82% above 2007 highs. Many are saying this is similar to 1987 and 2018.

DJIA Daily Chart YTD

US 10yr Treasury Weekly 5yr Chart

The name of this game is to keep what you made. With many stocks, trending south, there is no reason to get caught up in the Hope Trade.

Subscribe for $13 month and receive:

QQQTRADES Stock Idea List

QQQTRADES Dividend Stock/Covered Call Ideas

QQQTRADES Intermediate Term ETF Buy/Hold/Sell List

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

Not Even With A 10ft Poll

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

Not Even With A 10ft Poll

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024