News / QQQTrades.Club

US 10YR at 2007 Highs

US 10YR at 2007 Highs

October 3, 2023

Lending cost headed higher

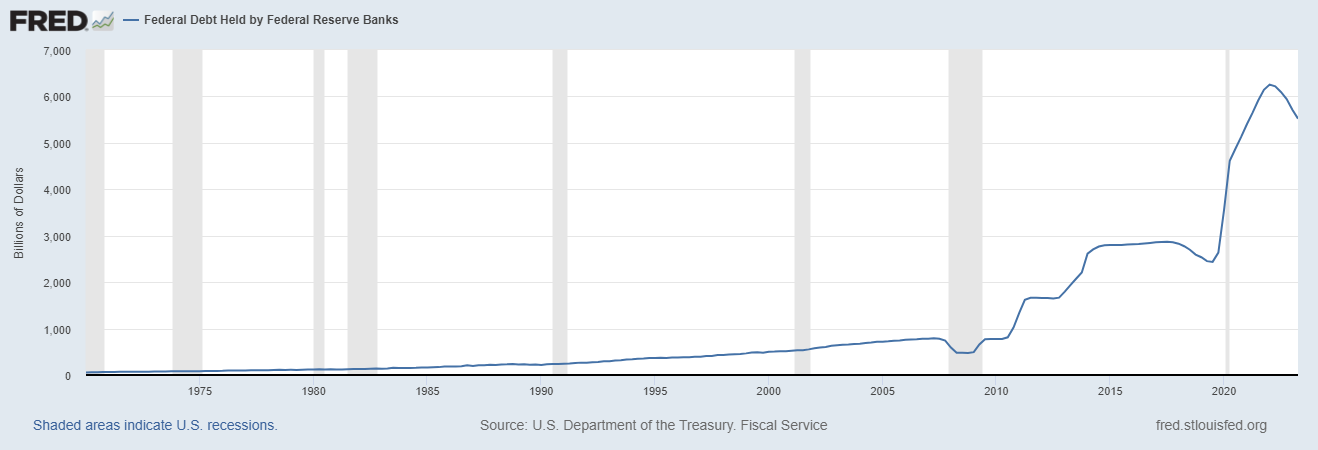

Bonds are not the exciting, high flying thrill ride that equities have been. Yet the bond market is larger than the equity market. They are the source of liquidity for company’s and nation states such as the United States. Since the USA is the reserve currency of the world, US Treasury’s are a major player when liquidity is need by countries. They simply take their Treasury’s to the Federal Reserve and exchange them for US Dollars. We saw a steady increase from 2010 to 2019 then saw a spike in in 2020 due to the pandemic which increased the Feds Balance sheet.

Since April of 2022 the Federal Reserve has been raising Fed Funds Rates and selling off their balance sheet.

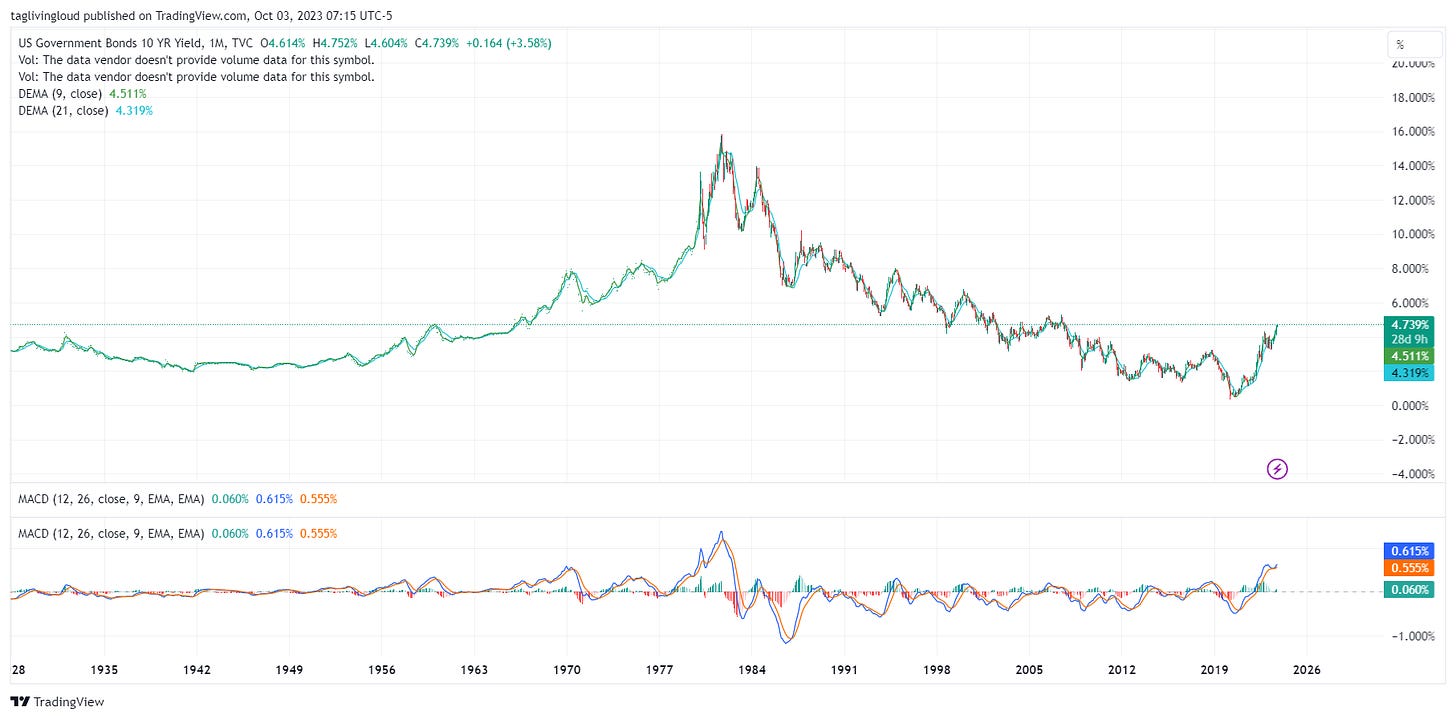

Today the US 10 YR broke above 2007 levels as of this post sits at 4.74%. We should expect to see levels of 5% or higher this month due to the selling of US Treasury’s. My theory to why this is happening is due to the cost of energy and food products. If you have to feed a nation, you sell assets to be able to buy those products that serve your country.

The problem we are seeing from the effect of the selling of Treasury’s is on the lending market. Mortgage rates, commercial loans and personal loan are headed higher because they are benchmarked off the US Treasury market, in particular the US 10 YR. This will then translate into slowing of the housing market, car loan market and corporate barrowing. The real GOTCHA is the refinancing of debt that was financed in 2020 at low rates to today and beyond. The US is expected to have to refi $5 trillion and the commercial real estate market is set to refi $1.5 trillion in the next twelve months. This is at 3 to 6 times the rate they originally financed it at.

It goes without saying that we should expect a continuation of bankruptcy filing over and above the 402 company’s YTD as of July 2023. For those who subscribe, you see my intermediate term Ideas on what to own and what not to own in my weekly Sector ETF Allocator. Today is about keeping what you got. Not buying to ride a rocket to the moon.

Volatility is Lurking

VIX continues to set up for a breakout towards 20. This will put downside pressure on the SP500 as well as other equity index’s.

Subscribe Today. $13 a month.

Share this article:

More in QQQTrades.Club:

Ultra Clean Holdings (UCTT) July 25, 2024, Earnings Call Summary

Future Price Projections Participants: Rhonda Bennetto – Senior Vice President, Investor Relations Jim Scholhamer – Chief Executive Officer Sheri Savage...

US 10YR at 2007 Highs

July 26, 2024

APPLE, MICROSOFT, NVIDIA PRICE TARGET 🎯

Short term, price targets for the top three S&P 500 holdings

Short term, price targets for the top three S&P 500 holdings The following are my price targets for the very...

Trent Grinkmeyer

July 25, 2024

Nvidia's Stake in Serve Robotics: A Game-Changer for AI-Powered Delivery?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in Serve Robotics, a company specializing in autonomous sidewalk delivery robots. This revelation sent Serve's stock soaring an impressive 233% over two days. But what does this mean for the future of AI-powered delivery, and should investors jump on board?

The tech world was buzzing last week when news broke that AI chip giant Nvidia owns a 10% stake in...

Trent Grinkmeyer

July 24, 2024

The Commercial Real Estate Crash

Its Ripple Effect on the Banking System and The Stock Market

The commercial real estate market is on the verge of a significant downturn, potentially mirroring the infamous 2008 financial crisis....

US 10YR at 2007 Highs

July 23, 2024

The Democratization of Compute

A Paradigm Shift in Business and Investment Artificial Intelligence (AI) is undeniably transformative, poised to revolutionize the world as we...

Kerry Grinkmeyer

July 23, 2024

Are Google and Meta Heading for a Stock Price Slump?

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major players. Today, I want to discuss two tech giants that have long been darlings of Wall Street: Google and Meta. While they've enjoyed impressive growth and dominance in their respective fields, there are signs that their stock prices might face some headwinds in the near future.

As an investor, it's crucial to keep a keen eye on market trends and potential shifts that could impact major...

Trent Grinkmeyer

July 23, 2024